ADAM DUSTAN

PRODUCT DESIGNER | SYSTEMS & FRAMEWORKS THINKING

Adam is a well-rounded Product Design lead and mentor who rallies around complex, ambiguous business and customer problems, shaking out viable, iterative solutions based on data-informed design thinking, external and internal feedback, scalable frameworks, and crispy visual design.

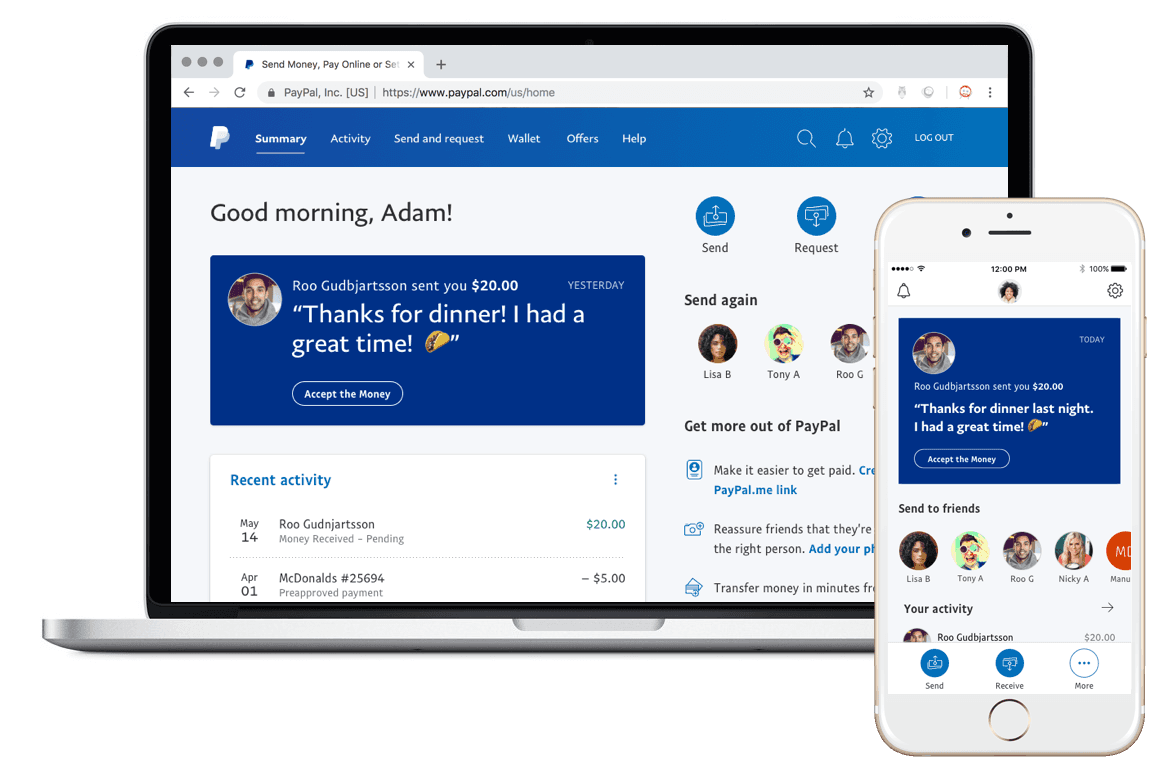

PayPal Consumer Servicing Dashboard

I led the redesign of the Consumer Servicing Dashboard, built around a novel back-end framework that tailors the experience to the individual customer and their unique journey (my 3rd US patent #11829704). I established scalable and pressure-tested UI and messaging frameworks to allow a half-dozen internal teams to more easily integrate and promote their features to 300k+ monthly active users, which mostly still appear to be live 6 years later.

PayPal | web & mWeb | 2018

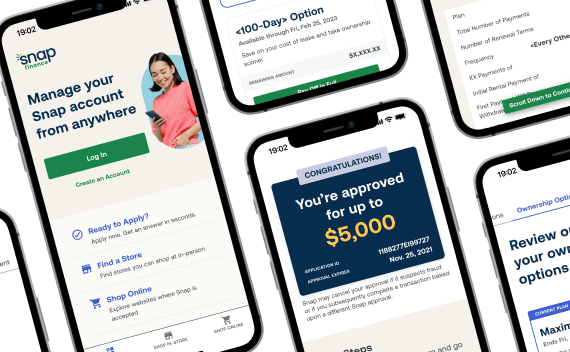

Snap Finance Maiden Mobile App

As the sole Product Designer in my first 6 months at this role, I was able to onboard quickly to design Snap's first mobile app encompassing an application process, account servicing dashboard, and store finder tool. I directly influenced product strategy by creating flow diagrams and wireframes on the fly in meetings that helped guide decisions and create PRDs, and influenced the back-end architecture by guiding the creation of a new authentication endpoint. I hatched a new cross-platform design system, and delivered iterated and tested customer experiences that adhered to strict FinTech regulations, bringing in a new source of revenue and acquisition for the company, with 400k+ downloads and a 4.9 rating in it's first year.

Snap Finance | mobile app | 2022

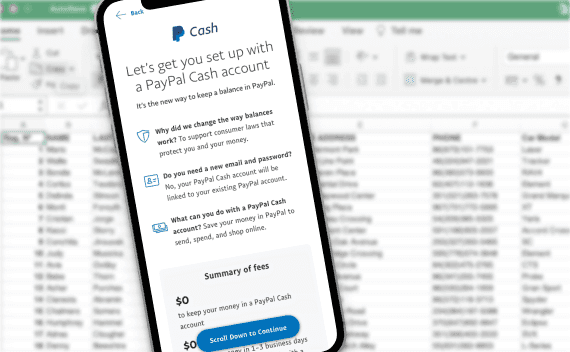

Fundamentally Changing the Core PayPal Product Offering

In response to a new CFPB law, PayPal leadership made the decision to require the customer to opt into creating a secondary account to hold a balance within PayPal. I led multiple rounds of usability and AB testing, reviewed extensive customer survey feedback, iterated on the design, and directed content, which ultimately improved adoption rates by +19.6% (relative). This account structure change to the PayPal product proved too confusing for our customers and harmful to the business, so the legal team was able to challenge the ruling and get PayPal correctly excluded from the new regulations.

PayPal | web & mWeb | 2019

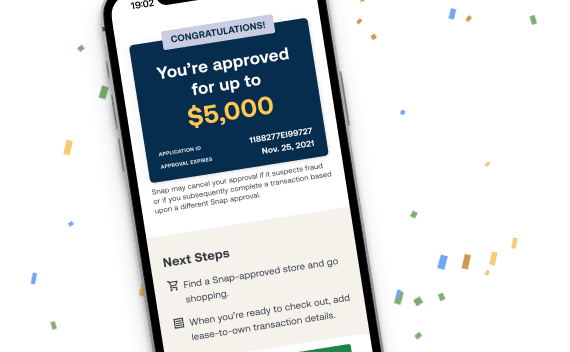

A Moment of Joy to Improve Completion Rates

Once a customer is approved with Snap Financing, they still need to sign their agreement and make their purchase. After leading a cross-functional workshop to discover areas for "quick wins" that could improve completion rates, one promising area of focus was the Approval page. I cleaned up and restructured content, improved scanability, and added a fun, motivating confetti animation. These iterated enhancements improved completions by +2.2% (relative), leading to an increase of $30M in annual revenue.

Snap Finance | web & mWeb, mobile app | 2023

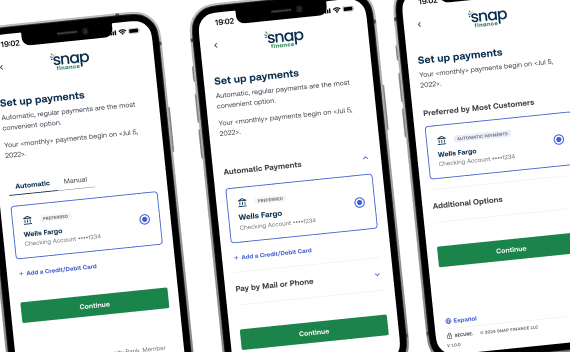

Increasing Transparency, Decreasing First Payment Default

One of the final steps before signing a loan agreement with Snap Finance is to set up a payment plan. The main goals and KPIs were to make the difference between automatic and manual payments clear to the customer, encourage an increased selection of the automatic option, and adhere to strict legal and compliance regulations. I came up with several viable options that were AB tested, with the best performing option increasing the automatic option selection and subsequently decreasing first payment default, benefitting both the customer and the business.

Snap Finance | web & mWeb, mobile app | 2024

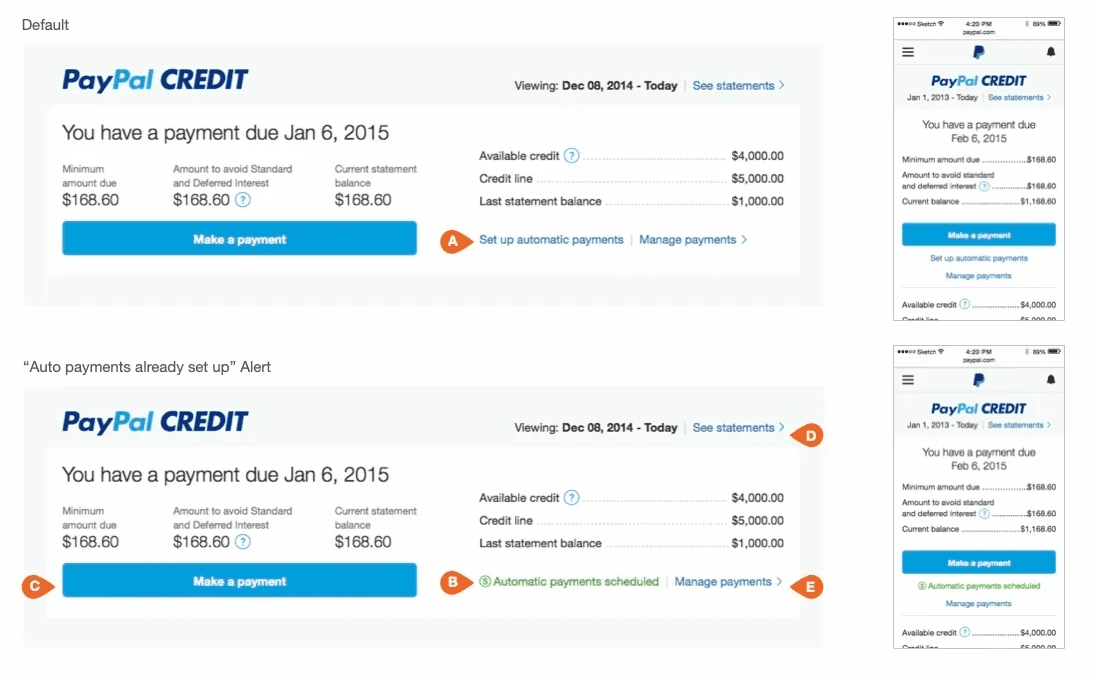

Bringing PayPal Credit online, leading to a 30% increase in customer spend

I was brought on as lead designer for the new PayPal Credit product, focusing on the UX & UI design of the servicing dashboard and payment flows, and also working directly with the Home & Wallet teams to get Credit seamlessly integrated into the core experiences. I worked on products released in the US, UK, and Germany, traveling overseas to talk directly to and test with European users to better understand their financial habits and regulations. I also held multiple CDI (Customer Driven Innovation) sessions with US users to better understand how to clear up confusion around credit and payment terms. PayPal Credit grew to a $6B portfolio with 10s of millions of users in its first few years.

PayPal | web & mWeb, mobile app | 2014–2015